Audience Key analyzed over 17,800 luxury bedding keywords to understand not only how product grids are shaping e-commerce visibility for top retailers but also how smaller brands can compete. The findings highlight just how much of the search landscape product grids now occupy, which stores are capturing the largest share, and how smaller brands can compete (and win).

Product Grids as Ecommerce Shelf Space

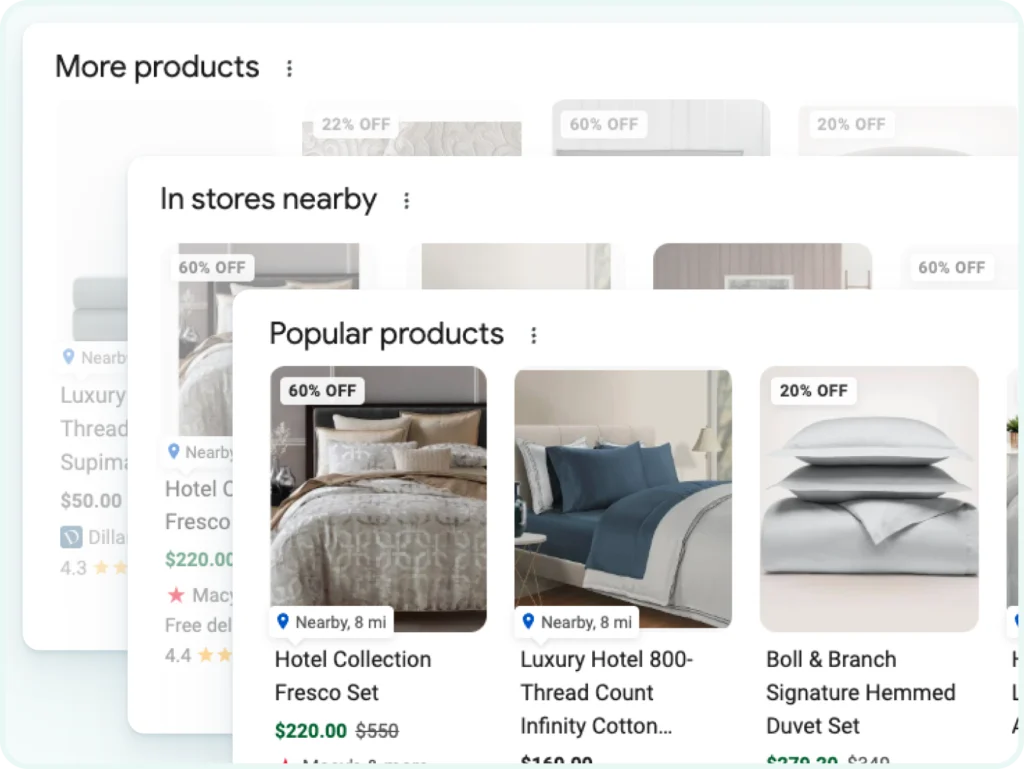

Product grids (AKA product feeds) are those visual blocks labeled Popular products, More products, or Recommended for you. They dominate Google’s shopping-related search results. They feature product cards showing images, prices, ratings, and merchant names, with multiple grids often stacked in a single SERP.

By the end of 2025, these grids have become the true “organic shelf space” of Google Search, driving more traffic potential than traditional blue links. As we head into 2026, visibility inside product grids — not link rankings alone — will define who captures demand and who gets skipped.

What Our Study Measures

Audience Key focused on three questions:

- How often do organic product grids appear for luxury bedding keywords?

- How many grids compete for attention on each results page?

- Which retailers dominate — and what’s the value of that visibility?

Findings: Who Captures Product Grid Visibility

1. Product grids are nearly universal.

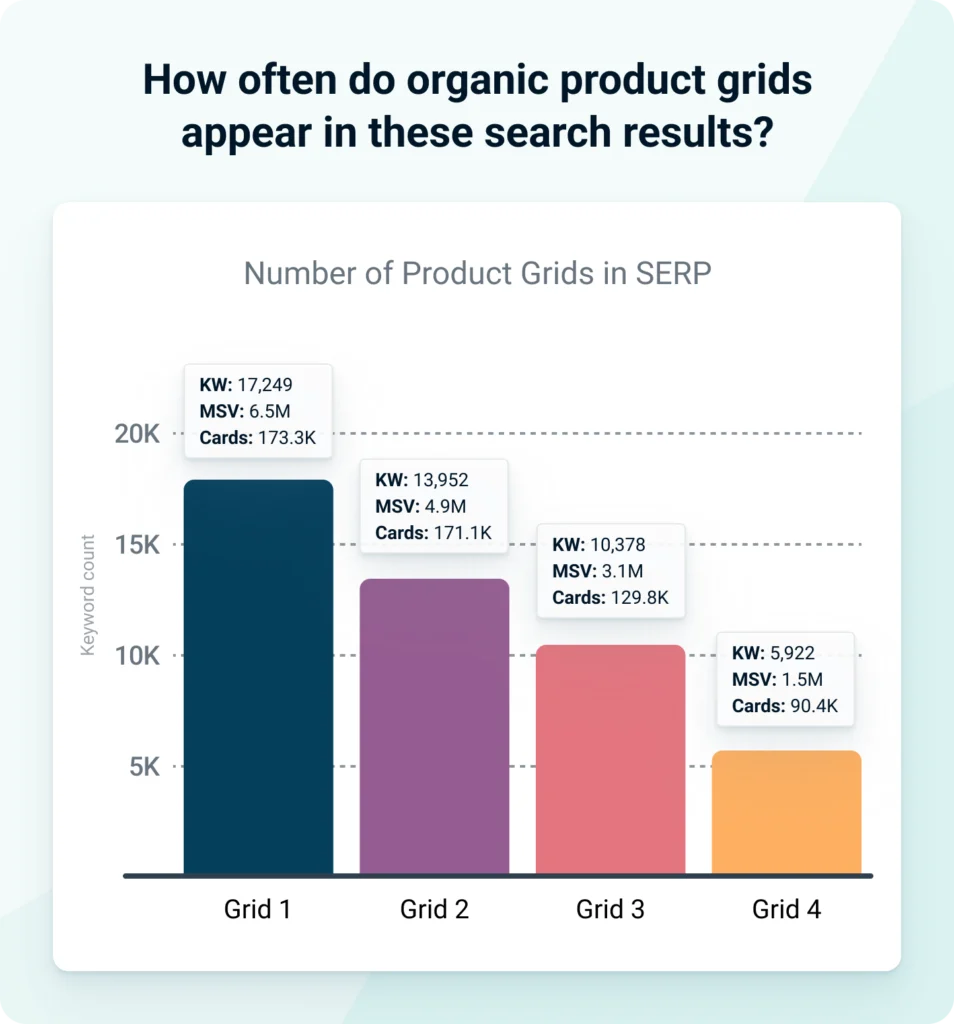

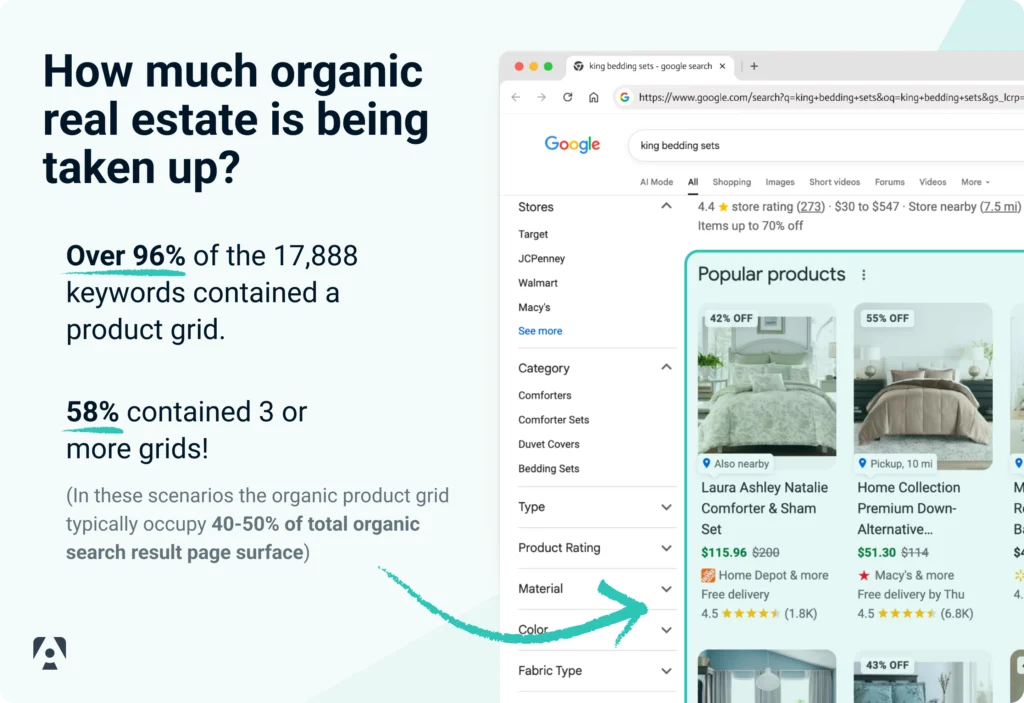

Over 96% of the 17,888 analyzed keywords contained at least one organic product grid.

In fact, 58% of those keywords included three or more grids, taking up roughly 40–50% of the total organic real estate on each search results page.

2. Product grid competition is intense.

Each product grid can showcase dozens of individual product cards — each with its own image, price, and store attribution — pulling listings from multiple retailers on a single results page. In the luxury bedding category, Macy’s, Target, Pottery Barn, and JCPenney appeared most often, but their presence wasn’t evenly distributed.

Macy’s showed up in nearly twice as many keywords as JCPenney and owned four times as many product card placements, indicating how grid dominance compounds visibility even when both retailers compete in the same category.

3. Macy’s dominates the luxury bedding SERPs.

- Macy’s appears in 70% of relevant keywords.

- JCPenney appears in 35%.

- Macy’s owns roughly 4x more product card appearances per keyword than JCPenney.

If JCPenney were to close that visibility gap, the estimated upside would be 1 million additional organic clicks per month, translating to more than $8 million in annual earned traffic value based on average CPC benchmarks.

The Takeaway for Ecommerce Brands

Grid inclusion isn’t random; it’s algorithmic and optimizable. Google’s product grids are fueled by structured data, content targeting, and merchant feed quality. Brands that treat these grids as a measurable SEO can track, test, and improve inclusion just as they would with traditional rankings.

*What’s It Worth: See footnote for model assumptions.

Winning merchants aren’t lucky — they’re deliberate. They monitor visibility shifts, refine their product data, and strengthen content relevance to stay present across more grids, more often.

The Takeaway for Smaller Ecommerce Brands

How can smaller ecommerce brands compete against big, well-known brands like Macy’s and JCPenney?

Organic product grids have permanently reshaped e-commerce SEO. For luxury retailers and marketplaces alike, visibility in these grids now defines who wins the click — and who disappears below the fold.

- You don’t need to outrank Macy’s. You need to “out-relevance” them.

- Focus on long-tail and specialty intent.

- Optimize your structured data and merchant feed first.

- Build topical depth and internal relevance.

- Track visibility over time.

For smaller brands, organic product grid strategy isn’t a lost cause. It’s a data opportunity.

The playing field isn’t equal, but it’s algorithmic, not exclusive. With disciplined data hygiene, category focus, and grid visibility tracking, smaller retailers can carve out meaningful organic shelf space, especially as Google continues to diversify product sources beyond just the largest merchants.

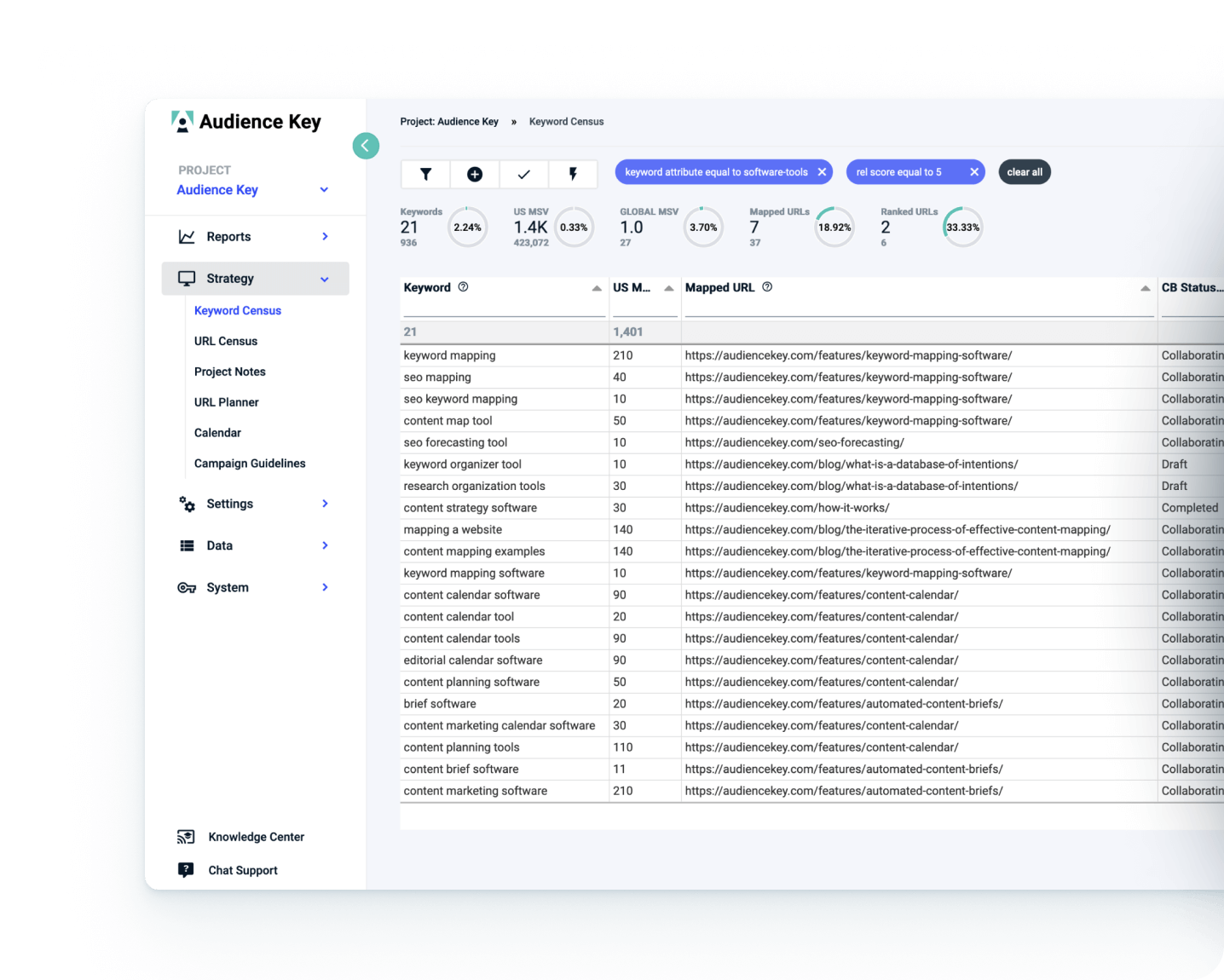

Audience Key’s Audience Grid™ makes this measurable. It tracks product grid presence by keyword, store name, and category, turning search data into actionable insights that reveal who’s winning, where, and why.

*The model estimates how much traffic and value retailers earn from Google’s organic product grids. It starts with JCPenney’s organic traffic, estimates how often product grids appear, and looks at how frequently JCPenney and Macy’s show up inside those grids. Because Macy’s appears more often and with more product listings, it earns higher click-through rates. Traffic value is estimated using typical paid shopping ad costs as a benchmark.

Assumptions & Inputs Behind the Model

- 9.4M monthly SEO visitors to JCPenney.com (SEMrush)

- 1.2% avg. CTR → 783M search impressions

- 69% of keywords include product grids → 540M impressions

- JCPenney appears in 35%, Macy’s in 70%

- Product card density: Macy’s = 5.2 cards/keyword, JCPenney = 2.5

- Product Listing Ads Avg CPC Estimate: $0.65

- Estimated CTRs: Macy’s = 0.40%, JCPenney = 0.25% (different CTRs due to product card density)