July 2025: Amazon’s exit from Google Shopping Ads made headlines for its impact on paid listings. But beneath the CPC chatter, a quieter disruption unfolded — creating one of the biggest organic search openings in years.

Across 79,000+ keywords, Audience Key’s first-of-its-kind tracking showed the effects of Amazon’s changes to its merchant feed — the approach initially wiped out 31% of its organic product card rankings. Weeks later, Amazon has now disappeared completely — creating a seismic shift that is immediately reshaping e-commerce SERPs and freeing up prime shelf space for rivals.

Amazon’s Move No One Saw Coming

In late July 2025, Amazon made e-commerce headlines when it pulled out of Google Shopping Ads.

The move sparked a wave of coverage and analysis about the effects on ad competition and CPCs. But one major part of the story flew under the radar: the organic impact.

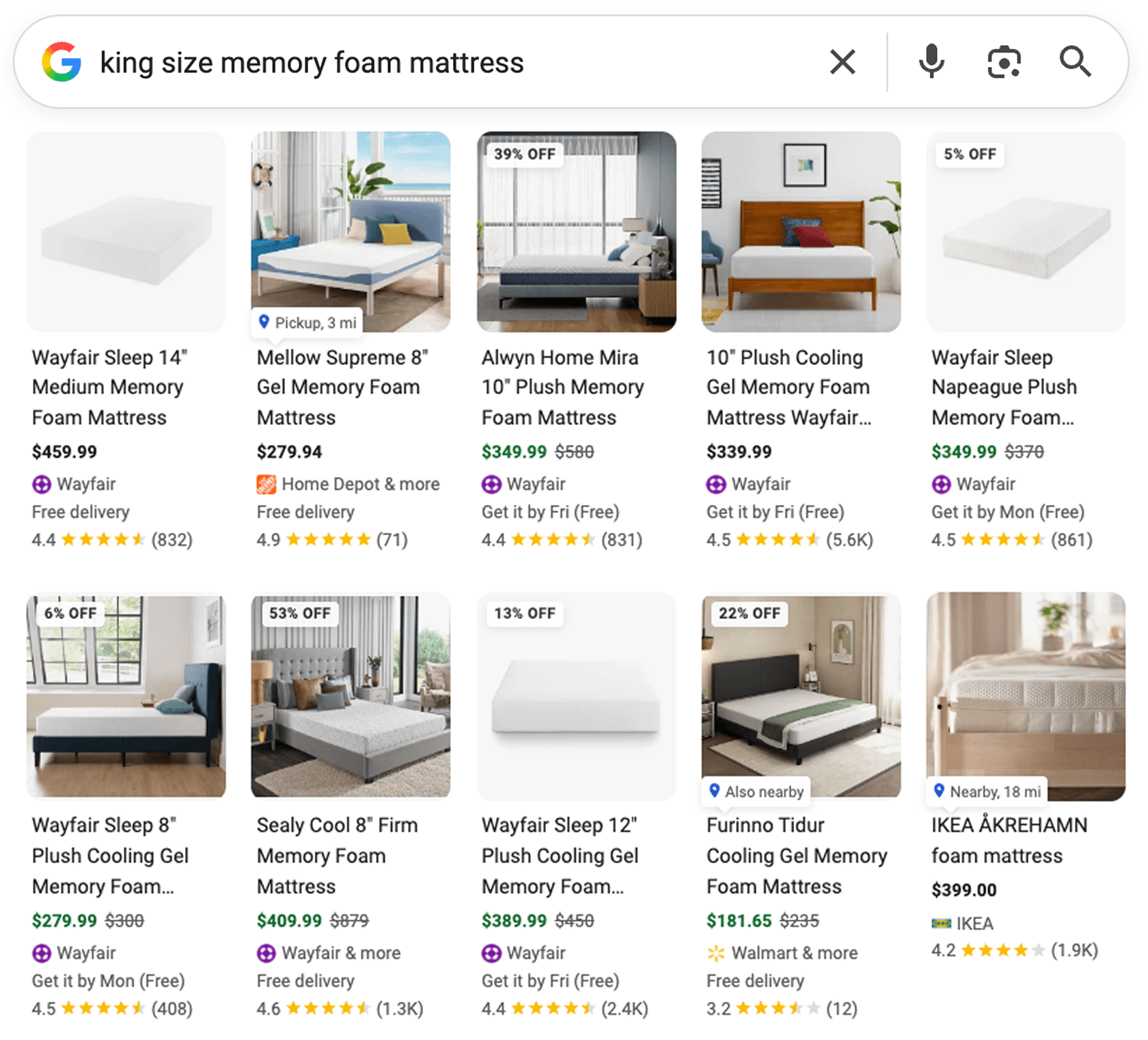

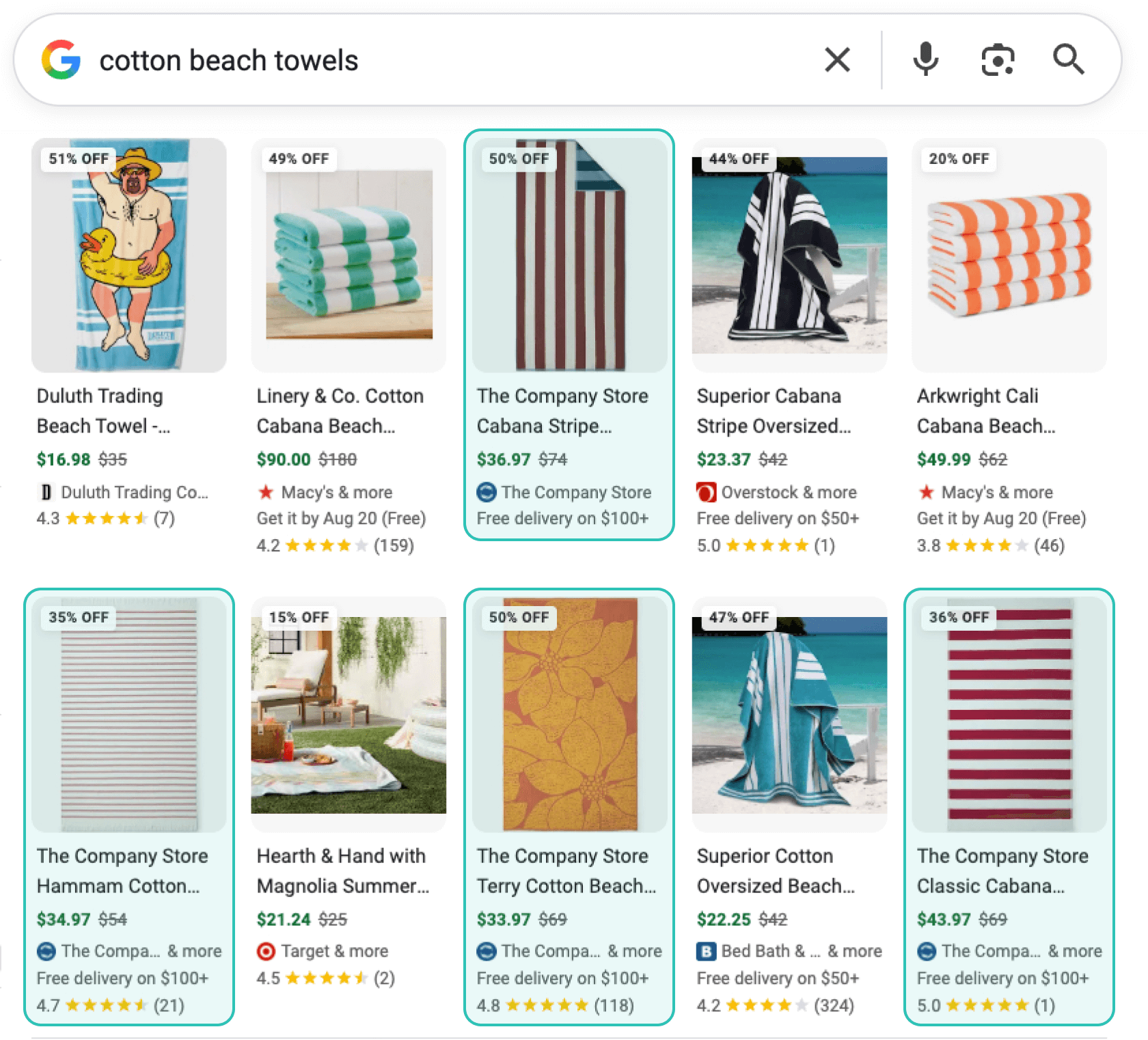

Specifically, we’re talking about organic product grids — often (but not always), labeled Popular products.

These grids are some of the most valuable real estate in e-commerce SERPs, yet they are largely not well understood and rarely tracked.

Are You Ranking in Popular Products?

Why Retail Marketers Missed the Organic Story

While paid shopping ads are easy to monitor through platforms like Google Ads or competitive intelligence tools, organic product grids have been a complete blind spot — until now.

Here’s why:

- No keyword-level data from Google — Neither Search Console nor Merchant Center reveals which queries trigger product grids.

- SEO tools track URLs, not Store Names — Product cards in organic grids are tied to a merchant store name, not directly to a website domain, making them invisible to traditional rank tracking.

- No visibility into growth trends — Marketers lacked data on how widespread grids have become, how many appear per SERP, and how this has evolved over time.

Without proper visibility, the organic impact of a move like Amazon’s can’t be quantified — leaving a massive opportunity hidden in plain sight.

Audience Key’s Rapid Response

From Invisible to Actionable: Audience Key Launches First-of-Its-Kind Technology to Track Organic Product Grid Rankings.

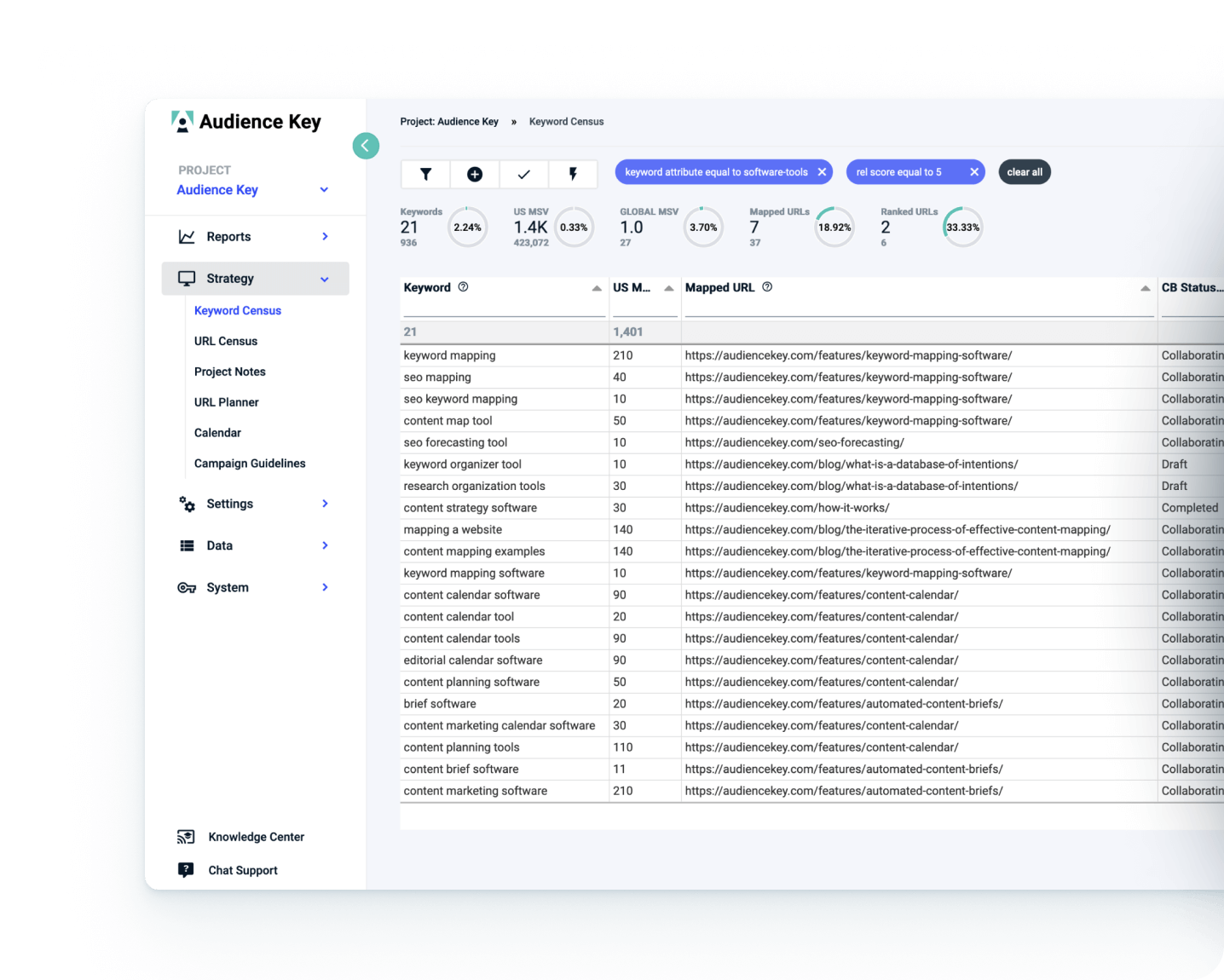

Since late 2024, we’ve been developing technology to track merchant listings in organic product grids at scale. Throughout 2025 Audience Key has expanded its reporting capabilities, collected cross-category benchmark data, and tested changes to merchant feeds and websites to measure their effects on organic product grid rankings.

The result? We have a before-and-after view of Amazon’s exit from paid shopping ads — and its ripple effect on organic shelf space.

The Dataset

We examined 79,000+ keywords featuring at least one organic product grid. These keywords span 14 unique projects across categories from apparel and home goods to scientific equipment and laptops.

We compared the most recent ranking reports taken before July 22, 2025, and compared those to reports taken after July 25 (allowing ~3 days for the Amazon change to roll out), and then a third date after August 16.

Highlights:

- In the first rollout, Amazon’s total organic product grid coverage in our dataset fell by 31%.

- Certain projects saw Amazon’s presence drop by as much as 60%.

- A 100% loss of U.S. coverage has been observed after ~August 16th.

Amazon’s Pre-July 22 Organic Presence

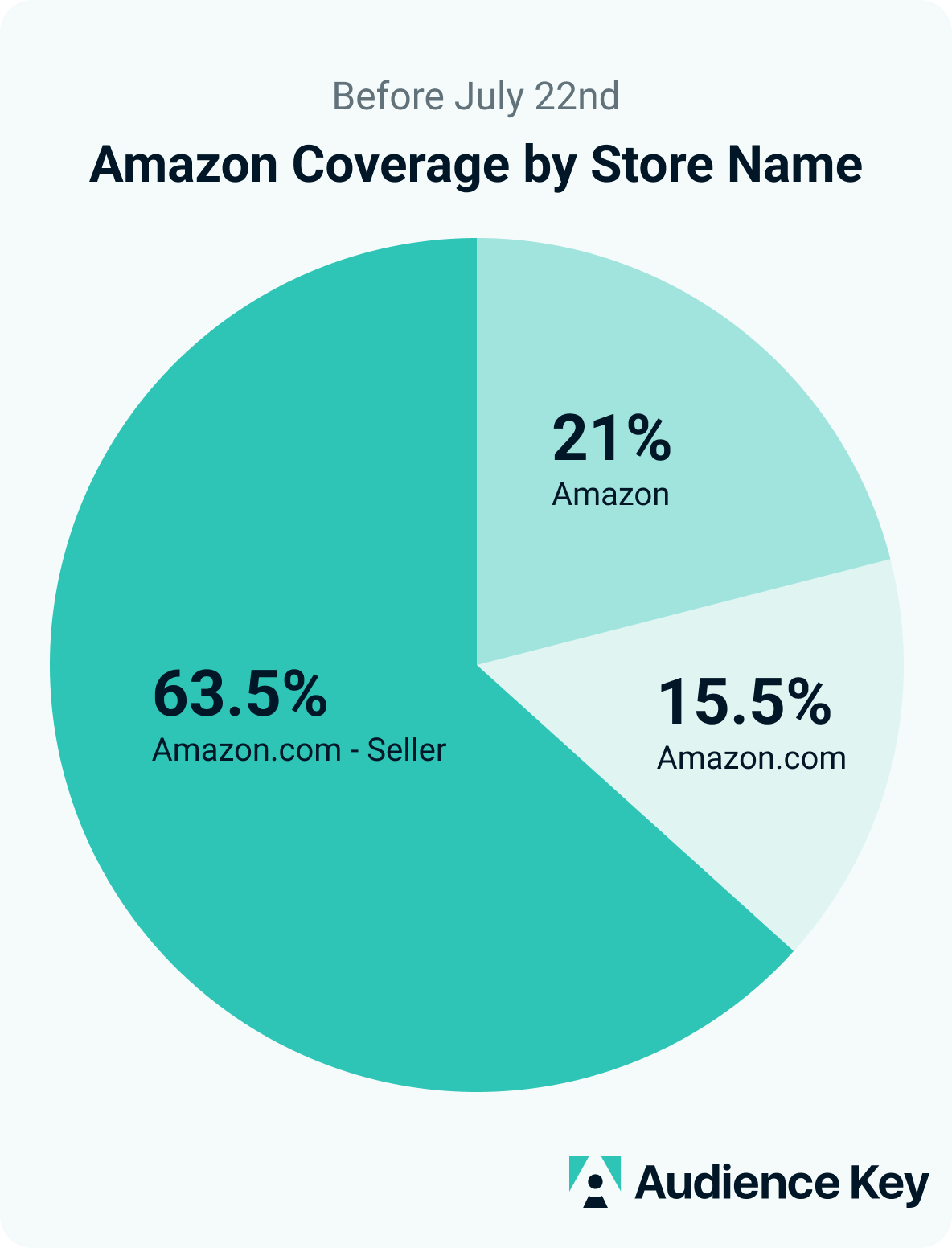

Before the change, Amazon appeared under three merchant store names in organic product grids:

- Amazon

- Amazon.com

- Amazon.com – Seller

In our data:

- Amazon.com – Seller accounted for 63%+ of Amazon’s organic listings.

- We never observed more than one Amazon store variation in the same SERP.

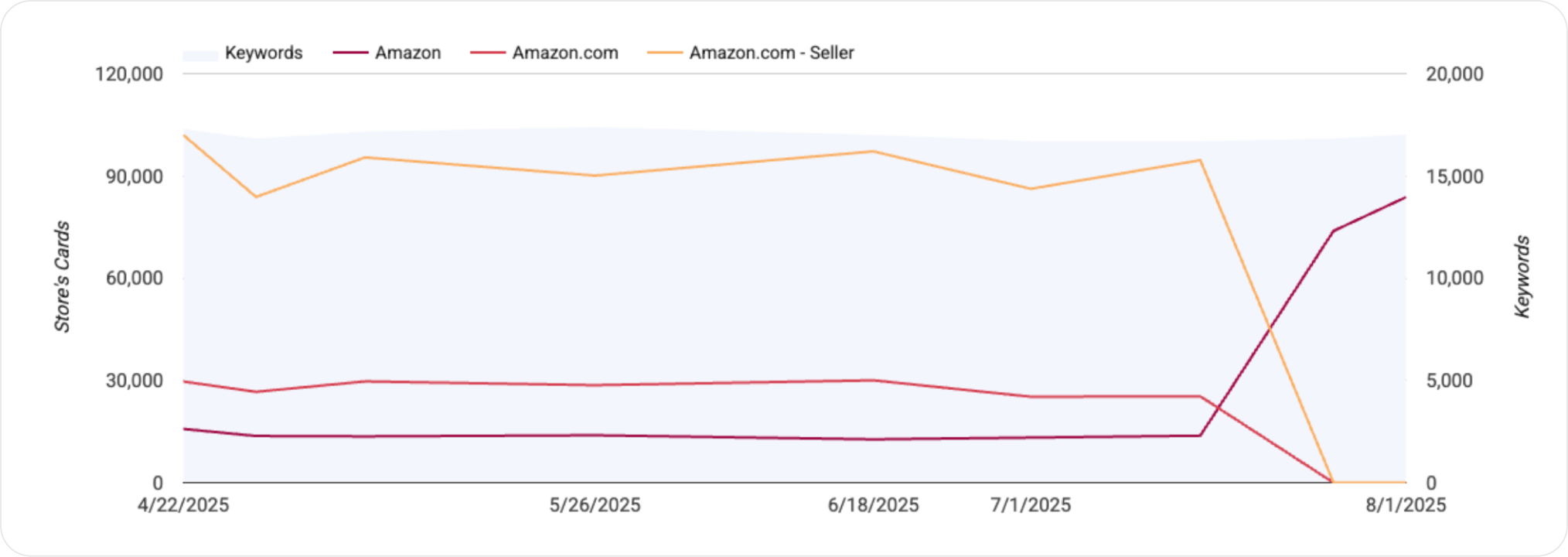

Amazon’s Post-July 25 Consolidation

When Amazon pulled out of paid shopping ads, it also consolidated its organic presence into a single store name: Amazon.

Products that previously displayed as either Amazon.com – Seller or Amazon.com often still appeared, just relabeled under Amazon.

This means third-party sellers weren’t cut out, but their visibility shifted under the single Amazon umbrella.

Net Impact: A 31% Drop in Organic Product Cards

| Store Name | Product Cards Before | Product Cards After |

|---|---|---|

| Amazon | 90,012 | 294,980 |

| Amazon.com | 66,612 | – |

| Amazon.com – Seller | 272,360 | – |

| Total | 428,984 | 294,980 |

In some categories, Amazon’s presence dropped by more than 60% overnight — opening massive space for competitors in those SERPs.

Looking across 79,000 keywords in 14 campaigns, Amazon’s total organic product card presence fell by ~31%.

Example: In a home furnishings campaign that tracks ~16,600 keywords:

On July 16, 2025, the three Amazon stores combined to show up for 133,717 unique product cards across these 16,600 keywords.

And Then, By July 27 …

- Amazon.com – Seller and Amazon.com dropped to zero.

- Amazon (the remaining of the three store names) listings rose sharply, but didn’t offset the loss.

Amazon Vanishes from Google’s US Organic Product Grids

We thought the first chapter of this story was complete, but just as we prepared this study for publication, everything changed. Again. Our latest U.S. search data reveals a stunning shift: Amazon vanished from the organic product grids.

Whether this is a short-term anomaly or a more permanent new normal, only time will tell. We will continue to monitor and report on our findings. The sudden removal leaves us — and the industry — asking one big question: WHY???

Why Would Amazon Pull Out of Organic Product Grids?

That is certainly a topic for speculation. Here are three possible explanations worth pondering:

- Amazon’s choice: Amazon may have decided not to share feed data with Google.

- Temporary change: A technical or strategic retooling — suggesting a return could be imminent.

- Google’s response: A retaliatory move after Amazon quit Shopping Ads.

Gone from Organic “Popular Products” Is Not Necessarily Forever

What we can attest to is that when a feed goes down for whatever reason, the changes in Google SERPs are basically immediate. We’ve tracked cases where feeds drop to zero overnight, only to be reactivated and repopulated in the grids just as quickly. This vanishing act could well prove to be a short-term anomaly.

So What Does a Complete Absence of Amazon Mean for Other Stores?

Based on tracked keywords: 79,029 across 14 projects

Here’s the data:

| Total Identified Product Cards | Total Amazon Store Cards | Percentage of Amazon Ownership | |

|---|---|---|---|

| Prior to July 25 | 2,059,381 | 428,984 | 20.8% |

| July 25 to August 15 | 2,061,853 | 294,983 | 14.3% |

| After August 15 | 0 | 0 | 0% |

The data in the sample set suggests that over 20% of the organic product card results previously captured by Amazon are now open and available for other stores.

In our 14 projects providing this data, we saw Amazon own as much as 40% of the product card results. In fact, in 8 of the 14 projects, Amazon had a 25% or greater ownership.

If Amazon remains absent, the digital shelf space it once dominated becomes an unprecedented land grab for rival merchants.

Findings: Yes, You Can Optimize for Organic Product Grids

How to Capitalize on the Amazon Vacancy

Organic product grids aren’t some mysterious black box you just hope to land in. Like any algorithm, there are clear levers you can pull to put your best foot forward and out-optimize your competitors.

And here’s what’s really exciting: Unlike traditional SEO, where we typically fight for a single blue-link slot, a well-optimized merchant store can claim multiple spots in the same SERP. That means you can dominate valuable, high-intent real estate — crowding out rivals and multiplying your chances of winning the click.

While there are factors at play, success comes down to three essential actions:

- Measure – Benchmark your current organic product grid presence. Identify where you’re winning and where you’re absent.

- Optimize – Refine merchant feeds, product data, and page structures to improve grid inclusion and rankings.

- Track – Monitor results over time to spot opportunities and measure the impact of every change- because you can’t optimize what you can’t measure.

When executed together, these steps turn organic product grids from a passive hope into an active, compounding growth channel.

Why This Matters for Other Merchants

This is an unprecedented opening in the organic e-commerce landscape.

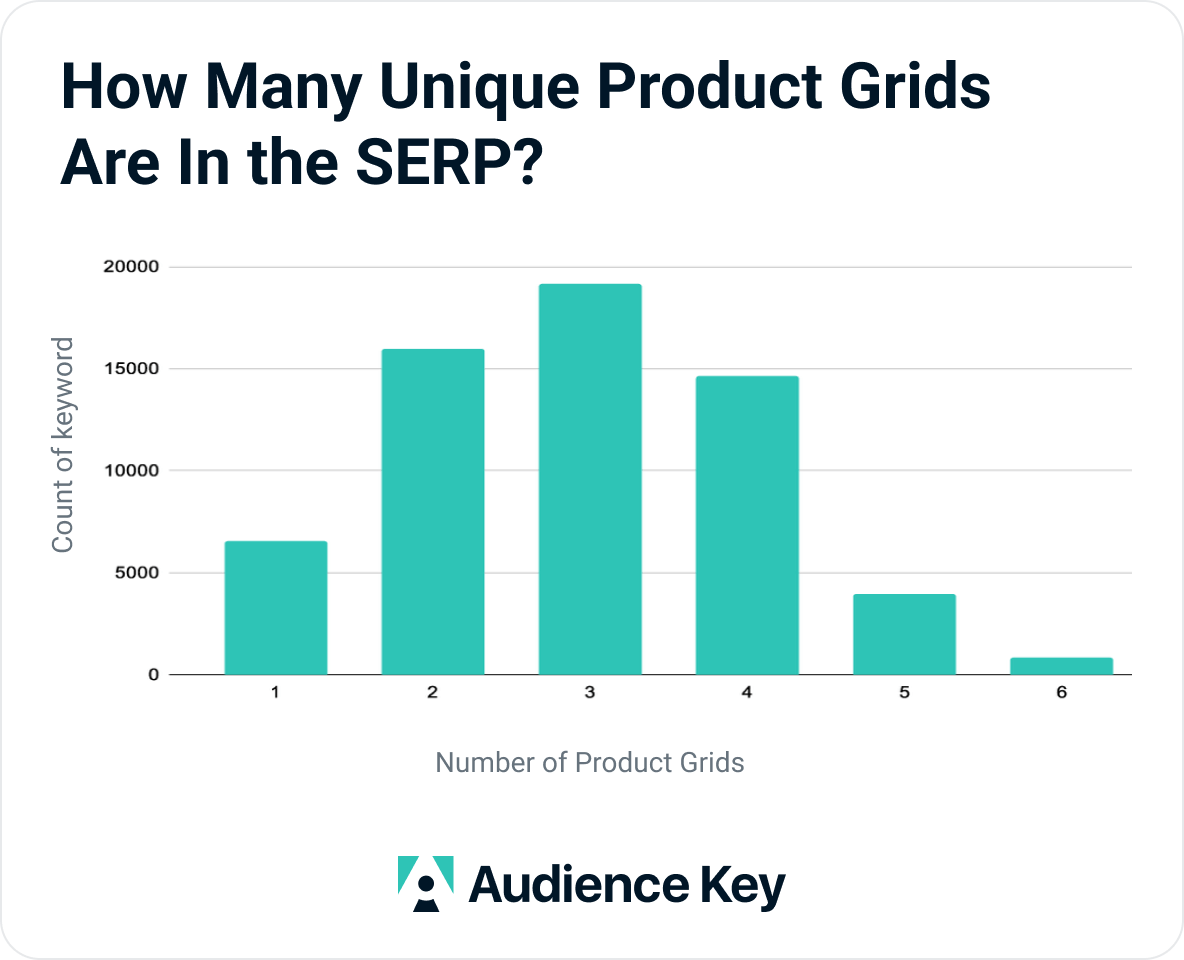

Back in April 2025, we ran a study on a large set of our data that found:

- 92%+ of transactional e-commerce keywords we track had at least one organic product grid.

- ~70% of those had three or more grids per SERP.

- SERPs with 3 to 4 grids see those grids occupy ~40% of total organic real estate.

If Amazon’s coverage first dropped by 31% and then eventually went to 0%, that means organic shelf space just seriously opened up and is there for the taking.

Track Your Organic Merchant Store Presence with Audience Key

This coming week, we are launching Audience Key Merchant Pro — giving you the visibility and competitive intelligence to win in a post-Amazon-pullout world.

Amazon’s change is fresh. The organic SERP real estate left behind is wide open. Early birds will be getting more worms.

#ShamelessPlug: Audience Key Merchant Pro shows you exactly where you stand today, where the gaps are, and the most opportune open grid positions to capture before your competitors do.

Bottom line: Amazon’s ad exit isn’t just a paid story — it’s an organic shake-up. The door is open, but you can’t optimize what you can’t measure. Now is the time to measure, move, and win.

Interested in early bird access? Join our early access list here.